Como ter equity?

Como ter equity?

A conta é muito simples, você só vai precisar ter em mãos o valor do lucro líquido da empresa e o seu valor patrimonial. Então, é só realizar a divisão entre o LL e o PL e multiplicar o resultado por 100. Dessa forma você terá em mãos o retorno que o Equity pode lhe proporcionar.

O que faz equity Sales?

O trabalho de um profissional de 'sales' em um banco de investimentos. ... Hoje, como profissional de sales do Bank of America Merrill Lynch, sua função é ajudar as empresas clientes a investir na Bolsa de Valores, sempre com ética e transparência.

What does it mean to have equity in your home?

Home equity is the difference between the appraised value of your home and the amount you still owe on your mortgage. Increasing your equity can help improve your finances; it affects everything from whether you need to pay private mortgage insurance to what financing options may be available to you.

How can I find out how much equity I have in my home?

You can figure out how much equity you have in your home by subtracting the amount you owe on all loans secured by your house from its appraised value. For example, homeowner Caroline owes $140,000 on a mortgage for her home, which was recently appraised at $400,000. Her home equity is $260,000. Current appraised value

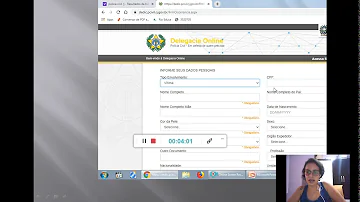

How to apply for a home equity line of credit?

Your home equity line of credit made easy. 1 Start online. Submit your secure application online - there's no fee and no obligation, and it only takes about 15 minutes. Start your application now ... 2 Work with a specialist. 3 Complete the process. 4 What can a HELOC help you do? 5 Top home equity FAQs. More items

How much equity can I borrow from Bank of America?

Your home's equity is the difference between the appraised value of your home and your current mortgage balance. Through Bank of America, you can generally borrow up to 85% of the value of your home MINUS the amount you still owe. For example, say your home’s appraised value is $200,000. 85% of that is $170,000.