Quando o payback simples é exatamente igual ao payback descontado o que temos?

Quando o payback simples é exatamente igual ao payback descontado o que temos?

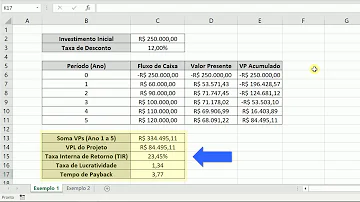

Logo, o payback descontado é igual ao payback simples, com a diferença de que considera os fluxos descontados (trazidos a valor presente) para encontrar quando os fluxos de caixa pagam o investimento inicial. ... Isto ocorre porque o valor presente acumulado não chega a zero.

How to calculate the payback period in years?

Calculate the payback period in years and interpret it. So the payback period will be = 1 million / 2.5 lakh or 4 years. So during calculating the payback period, the basic valuation of 2.5 lakh dollar is ignored over time. That is the profitability of each year is fixed but the valuation of that particular amount will be placed overtime period.

Which is a disadvantage of calculating payback period in Excel?

But there are a few important disadvantages that disqualify the payback period from being a primary factor in making investment decisions. First, it ignores the time value of money, which is a critical component of capital budgeting. For example, three projects can have the same payback period; however, they could have varying flows of cash.

Why do management look for a lower payback period?

In simple terms, management looks for a lower payback period. Lower payback period denotes quick break even for the business and hence the profitability of the business can be seen quickly. So in the business environment, lower payback period indicates higher profitability from the particular project.

When do you use a discounted payback period?

Discounted payback period is a capital budgeting procedure which is frequently used to calculate the profitability of a project. The net present value aspect of a discounted payback period does not exist in a payback period in which the gross inflow of future cash flow is not discounted.